- Titre du Projet : Blue Finance

- Coordination : Nicolas Pascal

- Période : Continu

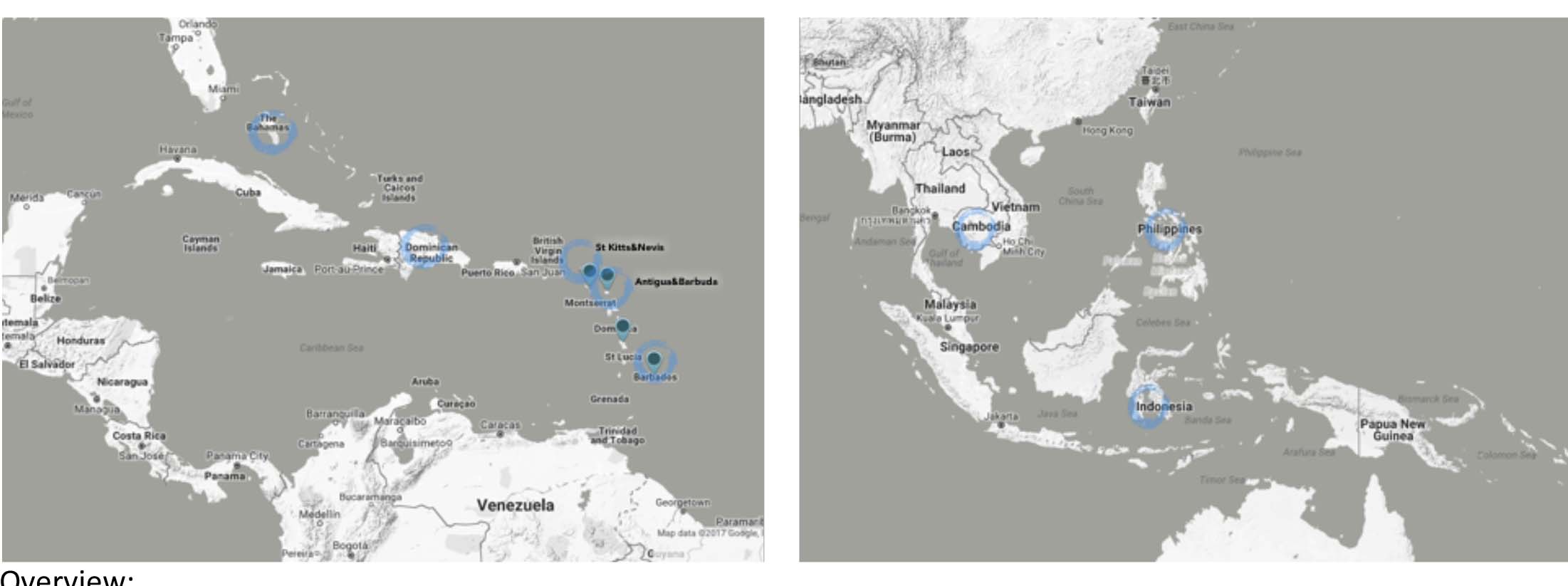

- Zone d’étude : Caraïbes (République dominicaine, Bahamas, Barbados, Antigua & Barbuda, St Kitts & Nevis, Martinique) Asie du Sud-Est (Philippines, Cambodge, Indonésie)

- Collaborateurs : Blue finance works under the institutional umbrella of the United Nations. Other partners include Althelia Ecosphere, Conservation Capital, Deloitte and Ropes&Gray. Blue finance partners bring over a decade´s experience in structuring more than US$220M of finance for over 75 Public-Private-Partnerships (PPPs) and conservation projects across 26 countries.

Résumé :

- Our Mission is to ensure the efficient management and sustainable financing of Marine Protected Areas (MPAs) through leveraging new investment models.

- Our strategy is to design, finance, and implement Public-Private Partnership (PPP) agreements for the co-management of MPAs.

- Our long-term objective is to have 20 MPAs efficiently managed in developing countries before 2030.

Expected positive impacts of the projects contribute to SDGs nº14, 1, 5, 8 and 13 through:

- Protecting 25.000 km2 of coral reef ecosystems from local threats

- Improving the livelihood of 200.000 households through sustainable fisheries (food and incomes) as well as opportunities for tourism businesses.

- Increasing climate change resilience through shoreline protection.

Our primary achievements include:

One of the largest MPAs in the Caribbean is under a co-management scheme and expected to improve the health of 8000 km2 of critical marine ecosystems and enhance the livelihoods for 16 000 households in the Dominican Republic.

- Structuring US$3M of finance with impact investors for the Dominican Republic MPA.

- Innovative Public Private Partnership concept developed and launched for leveraging private capital to finance MPAs.

- An additional 7 MPAs are in development in the Caribbean and in South East Asia.

Our primary activities cover:

- PPP development (conceptualizing and structuring the co-management of MPAs)

- Project fundraising (designing impact investment/blended finance solutions for MPAs)

- Project management (providing environmental, marketing and financial oversight to MPAs)

Our structure:

Blue finance Inc. (Bf) is a social enterprise built around an NGO created in 2015 in Vanuatu. Its HQ is in France with operating hubs in Barbados and the Philippines.

THE BLUE FINANCE APPROACH FOR MPAs

Blue finance MPA projects directly address local stresses which are primary hindrances to marine health and sustainable development of the countries. With control of local stressors, marine ecosystems are better able to handle global pressures.

In each of our projects, the MPA is expected to implement efficiently the following activities:

• Improvement & Monitoring the health of marine habitats (e.g. sustainable fisheries, water quality, tourism carrying capacity, reef restauration, etc.),

• Compliance & Enforcement (e.g. patrolling, zoning, etc.),

• Community engagement & Livelihood enhancement (e.g. awareness campaigns and creation of new income generating activities, mainly with fishers),

• Support to tourism activities (e.g. MPA branding, UW attractions, visitor centre, etc.),

• Management and Revenue mechanisms (e.g. marketing plan, user fee collection, etc.)

Each MPA is proposed to be jointly managed with a non-profit entity through a co-management agreement (Public-Private Partnership, PPP) signed with each Government. PPPs have proven to be an effective solution to improve the effective management and sustainable financing of MPAs in many countries (e.g. Bonaire, Belize, Dominican Republic, Indonesia, etc.).

The main advantages of these agreements are, among others: (i) To improve entrepreneurial approaches to the management of Protected Areas. This includes the flexibility to: establish financing mechanisms, retain monies earned and to have the freedom to implement staffing policies based on market efficiency and wages; (ii) For Governments, these agreements reduce the financial burden on Public Budgets.

To obtain these benefits, clear and precise rules must be defined with respect to both partners´ (Government and Co-Management Entity) obligations as well as monitoring, incentives, personnel, etc. of the Co-Management Entity.

On-Going Projects

Dominican Republic: co-management of the Santuario Marino Arrecifes del Sureste or Southeast Marine Reef Sanctuary

80,000 km2 of coastal ecosystem (incl coral reef)

Expected benefits for 16,000 households

>4M visitors annually

Investment: US$4M (expected in Q2 2019)

Bahamas: co-management of the SW New Providence Marine Management Area

90k km2 of coastal ecosystems (incl. coral reef)

Expected benefits for 4,000 households

4M visitors (2017)

Investment: US$2.5M (expected in Q2 2019)

Mindoro (Philippines): co-management of 5 Protected Areas

45km2 of coastal ecosystems (incl. coral reef)

Expected benefits for 12,000 households

0.4M visitors (2017) , annual user fees > US$0.5M

Investment: US$1M (Q2 2019)

Barbados: co-management of the future Barbados Marine Management Area

70 km2 of coastal ecosystems (incl. coral reef)

Expected benefits for 6,000 households

1.2M visitors (2016)

Investment: US$2.5M (Q4 2019)

Sabang, Aceh (Indonesia): co-management of 2 Protected Areas

60 km2 of coastal ecosystems (incl. coral reef)

Expected benefits for 8,000 households

0.6M visitors (2017) , annual user fees > US$0.5M

Investment: US$1M (Q2 2019)

Antigua&Barbuda: co-management of 3 Protected Areas

33 km2 of coastal ecosystems (incl. coral reef)

Expected benefits for 800 households

1M visitors (2016)

Investment: US$2M (Q2 2020)

St Kitts&Nevis: co-management of the Marine Management Area

200km2 of coastal ecosystems (incl. coral reef)

Expected benefits for 2,000 households

1.1M visitors (2016) , annual user fees > US$0.7M

Investment: US$2M (Q1 2020)

Koh rong (Cambodia): co-management of 3 Protected Areas

80km2 of coastal ecosystems (incl. coral reef)

Expected benefits for 18,000 households

0.6M visitors (2017) , annual user fees > US$0.5M

Investment: US$1M (Q2 2020)

Partners

Blue finance works under the institutional umbrella of the United Nations. Other partners include Althelia Ecosphere, Conservation Capital, Deloitte and Ropes&Gray. Blue finance partners bring over a decade´s experience in structuring more than US$220M of finance for over 75 Public-Private-Partnerships (PPPs) and conservation projects across 26 countries.

The Team

Team: The current team consists of 12 professionals with 3 permanent staff members (CEO, Caribbean manager, and Strategic Communication Specialist), 2 external country managers (Indonesia and Philippines), 2 external project control officers and 6 external experts distributed worldwide. The team has a long history and expertise in marine ecology and conservation, MPA management, conservation finance, fisheries management, business planning & development, public-private partnerships and community development.